Why are utilites so bad?

Jim Kramer: "I told you last night the rapid rise in interest rates has changed the calculus of this market, [and] the stocks of companies that rely on financing because borrowing money has gotten a lot more expensive in this environment where the Fed intends to leave short rates higher for longer I know you've heard that phrase.

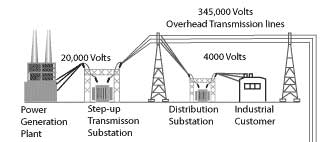

You want companies that have loads of cash and don't need to raise money, which what we've focused on. Tonight though little darker, we want to talk about this the higher for longer losers, and there are a lot of them and we're talking entire sectors, for starters, Utilities that go broke constantly just to keep their existing machinery running, let alone build a new one.

That's why the stocks have been hammered over the past few months. The utilities collapse into the September 20 Fed meeting. Where Wall Street realized that higher for longer was the new normal. The Utes are now the worst performing sector in the s&p for 2023. With the best proxy for the group utility selects sector Spyder ETF 70% year to date.

Dividend stocks and their yields are a lot less attractive in a world we can get almost 5% From to your treasuries as I said at the top of the show, now that said My God has seen is that it might be too late to sell utilities.

Now. Higher rates for longer will definitely hurt their earnings. But I've got to wonder if that's already baked into the stock prices down here.... But for now, let's stay on the sidelines. Who else loses in this environment? Any industry with high capital spending commitments that need regular financing.

https://www.cnbc.com/jim-cramer/

Comments