Coronavirus stirs the drink

|

| Purelle at Peril |

The coronavirus has been a shock to the system, a Black Swan, the straw that stirs the drink. But what was in the drink? A mix of improving employment and declining corporate operating profits, trade-war. Monetary supply and inverting interest rates.

Now is the time when the Wall Streeters embrace TINA – that is, the notion that There Is No Alternative – to equities. And they need yet more inversion just to maintain their illusion. The stock market, writes Barron's Randall Forsyth, is disconnected from the real economy.

The seers are still sussing out what is different about the coronavirus malady. Forsyth cites Kenneth Rogoff, who says it is important to understand that a recession (looming, still) driven by a supply side shortfall, rather than a demand-side impetus – that generalized shortages as some of us saw in the 1970s (gas, bread, flour, etc.) can push inflation into hyperdrive.

"You can observe a lot by just watching." - Yogi Berra

It was a raucous, volatile week, as airport activity slowed, movie crowds thinned, and church goers (after buying-out the local supply of hand sanitizer) stayed home in bigger droves than usual. But in the end the DJIA was up 1.8%. Gold too was up, a heftier 6.8%. Utilities finally upticked (7.9%) and Oil and Gas continued to plummet (7.79%), with Russia and Saudia Arabia taking different tacks. – B.B.

Related

https://www.barrons.com/articles/the-rate-cut-drug-might-not-cure-ailing-market-51583545555

https://www.project-syndicate.org/commentary/next-global-recession-hits-the-supply-side-by-kenneth-rogoff-2020-03

https://en.wikipedia.org/wiki/Panic_of_1907

|

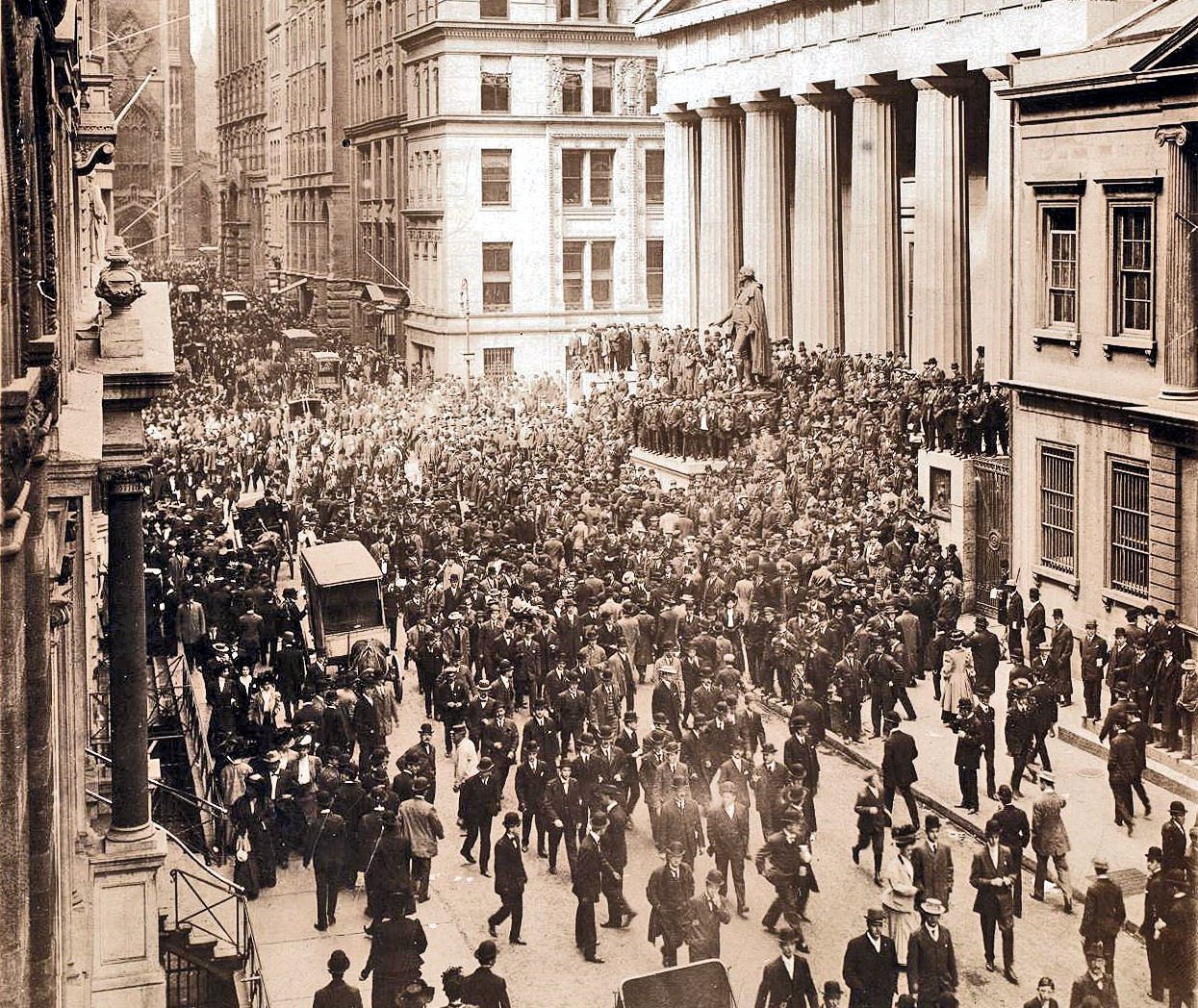

| Wall Street during1907 panic.* |

*The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. Primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops. The panic was triggered by the failed attempt in October 1907 to corner the market on stock of the United Copper Company.

Purelle at Peril

Comments