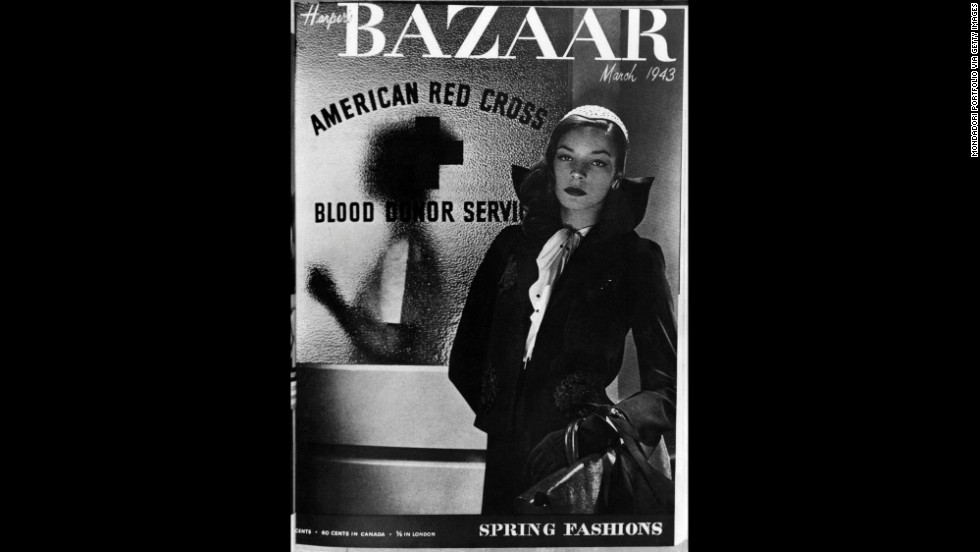

When models meet mystery

One of Wall Street’s Most Popular Trading Strategies Is

Now Failing https://www.bloomberg.com/news/articles/2019-03-01/one-of-wall-street-s-most-popular-trading-strategies-is-now-failing

Trend following quants look to buy on the upswing and sell on the downswing. Duh. They work based on application of selected features or trends disclosed in historical data by algorithms that robotically (nee, unsentimentally) cull for moving averages, inflection points and so on. They did well in 2008, but not since then. They did in December but not last year. They seem to have trouble with volatility, which has been missing from the market, and hasn't clearly yet to return.

Examples of trends [elements or signals] to include in models could be S&P futures, U.S. Treasuries and Crude oil prices - areas that have been discussed here and which should be reviewed. But they can, like derivatives, get far more far more exotic. They don’t appear to leave much room for uncertainity which most observers would agree is the straw that ultimately stirs the drink called reality. And reality is a many-headed mystery. An excerpt:

It is a strange time. Chaos has become the norm. But it is not a type of norm favorable to Trends trading, some say. Future predictions require

The Dow ranged last week from a high of 26,126 to a low of 25,902 - ending the week up 110 pts or +0.43% at 26,026. This despite, a rocking Senate roast of Pres Trump by his long time associate Michael Cohen, border skirmishes between India and Pakistan, indictment of Israeli prime minister, failure of peace talks with Korea.

Dow Jones Industrial Average

26,026.32

INDEXDJX: .DJI - 4:54 PM EST

+110.32 (0.43%)

S&P 500 Index

2,803.69

INDEXSP: .INX - 4:54 PM EST

+19.20 (0.69%)

FTSE 100 Index

7,106.73

INDEXFTSE: UKX - 4:35 PM GMT

+32.00 (0.45%)

EUR / USD

1.14

3:48 AM UTC

0.00 (0.00%)

OIL

INDEX UNITS PRICE CHANGE %CHANGE CONTRACT TIME (EST) 2 DAY

CL1:COM

WTI Crude Oil (Nymex)

USD/bbl. 55.80 -1.42 -2.48%

GOLD

INDEX UNITS PRICE CHANGE %CHANGE CONTRACT TIME (EST) 2 DAY

GC1:COM

Gold (Comex)

USD/t oz. 1,299.20 -16.90 -1.28%

Trend following quants look to buy on the upswing and sell on the downswing. Duh. They work based on application of selected features or trends disclosed in historical data by algorithms that robotically (nee, unsentimentally) cull for moving averages, inflection points and so on. They did well in 2008, but not since then. They did in December but not last year. They seem to have trouble with volatility, which has been missing from the market, and hasn't clearly yet to return.

Examples of trends [elements or signals] to include in models could be S&P futures, U.S. Treasuries and Crude oil prices - areas that have been discussed here and which should be reviewed. But they can, like derivatives, get far more far more exotic. They don’t appear to leave much room for uncertainity which most observers would agree is the straw that ultimately stirs the drink called reality. And reality is a many-headed mystery. An excerpt:

Turns out the algorithms behind so-called trend-following quants are rather primitive and suffer from many of the same weaknesses a mortal brain might. They've struggled to react fast enough to the unforeseen side effects of ending a decade of central bank stimulus, and even seem to get baffled by U.S. President Donald Trump. Personal income cooled, and factory growth slowed in U.S.

It is a strange time. Chaos has become the norm. But it is not a type of norm favorable to Trends trading, some say. Future predictions require

The Dow ranged last week from a high of 26,126 to a low of 25,902 - ending the week up 110 pts or +0.43% at 26,026. This despite, a rocking Senate roast of Pres Trump by his long time associate Michael Cohen, border skirmishes between India and Pakistan, indictment of Israeli prime minister, failure of peace talks with Korea.

Dow Jones Industrial Average

26,026.32

INDEXDJX: .DJI - 4:54 PM EST

+110.32 (0.43%)

S&P 500 Index

2,803.69

INDEXSP: .INX - 4:54 PM EST

+19.20 (0.69%)

FTSE 100 Index

7,106.73

INDEXFTSE: UKX - 4:35 PM GMT

+32.00 (0.45%)

EUR / USD

1.14

3:48 AM UTC

0.00 (0.00%)

OIL

INDEX UNITS PRICE CHANGE %CHANGE CONTRACT TIME (EST) 2 DAY

CL1:COM

WTI Crude Oil (Nymex)

USD/bbl. 55.80 -1.42 -2.48%

GOLD

INDEX UNITS PRICE CHANGE %CHANGE CONTRACT TIME (EST) 2 DAY

GC1:COM

Gold (Comex)

USD/t oz. 1,299.20 -16.90 -1.28%

Comments