Signal, noise and timing

Read WSJ article about timing the market. In horse racing and investing both - timing seems to be a rare trick.

🔃 Retweet if you're team "bite." ❤️ Like for "savage."— Horse Racing Nation (@HR_Nation) September 22, 2018

Firenze Fire held on despite some rarely seen interference from Whereshetoldmetogo in @parxracing's Gallant Bob Stakes. pic.twitter.com/FcgliVPBcS

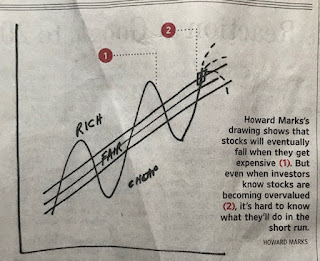

Humans seem to be of a couple of minds. These collide as they consider the issue of timing. That emerges as writer Jason Zweig reviews upcoming book Mastering the Market Cycle by Howard Marks. The book says markets move in multiyear cycles - that is an issue of special conjecture now as the market looks primed for yet another year of fantastic upness, but with, as always, many pesky piranha of doom prowling.

Turing points can be recognizable, but they are rare and far apart. Investors who think they see turning point as they look at short term signals are usually looking at noise. Mr. Marks holds that we cant predict the future but we can identify where we are in a cycle.* That calls for study of long cycles. And all you can hope for is to reduce risk at the right time and take on risk at the right time - that instead of "Mastering the cycle" [Marks prefers the book's subtitle "Getting the odds on your side" - a goal which seems to be the only thing that top-notch handicappers have in common.

Marks' bon-mots: Recent performance doesn't tell us anything we can rely on about the short-term future but it does tell us something about the longer term probabilities or tendencies." While mood-driven human nature mitigates against this.

The position he advises right now is one moderately tilted toward defense.

Came across another discussion. In none other than The Signal and Noise, which I endeavor to finish, even tho portions seem to be on the dismal science. Again.. there are two minds of people one is slow track one is fast track one is analysis one is noise they both exist since the market is composed of humans in the end.

Silver says a basic statistical Power Law (https://en.wikipedia.org/wiki/Power_law ) works to some degree to i.d. bubbles. noting a lot of people saw the 2008 bubble ahead of time.

*Re "identify where we are in a cycle" - And, came across yet another discussion (Boy things are all coming together!) . In none other than Stock Market Logic, a book inherited from my dear dad. This is just the basics, mam - in fact, the original purpose of The Dow Index was to identify the present trend of the market, not forecast its future!

-------------------------------

*Re "identify where we are in a cycle" - And, came across yet another discussion (Boy things are all coming together!) . In none other than Stock Market Logic, a book inherited from my dear dad. This is just the basics, mam - in fact, the original purpose of The Dow Index was to identify the present trend of the market, not forecast its future!

-------------------------------

We're updating with reaction to connections of Midnight Bisou and Monomoy Girl after a controversial DQ handed the latter her first loss of the year: https://t.co/9p6kWpqdeR pic.twitter.com/C6CQM2Wm6f— Horse Racing Nation (@HR_Nation) September 22, 2018

Funny day at the races yesterday was. Firenze Fire withstands a savaging attach from Whereshetoldmetogo in the Gallant Bob Stakes (abve) - And Midnight Bisoux finally caught a break, benefiting from a steward's decision versus Monomy Girl in the Cotillion(top of page).

What I feel as though I learned from the Sport of Kings yesterday was not in these races but in others - The Nobel Damsel (Uni) and The Kelso (Patternrecognition)What I may have learned..a steady progression fwd of Beyers may be good sign - 1 for 1 or 2 for 2 at Distance seemed to be good sign. Having won last seemed good sign. Being among those with high speed #s seemed good.These things seem to distinguish winner from a horse that is off by 1/2 or so lengths.sigh. (A recent emphasis I placed on absolute actual time did not seem to hold.)

Today the rubric held up in 1 of 2 cases. In the failed case (Black Tie roles in Ashley T. Cole) there was reason to doubt one of speed numbers, there was an exceptional workout (both of these were pointed out in Trackman analysis, tho they seemed mundane, obligatory comments (horse went off at 28-1))(what happened was the winner got an easy lead and held on - which could well have been forseen in a thorough Pace analysis). - Romeo

Comments